Copper Price Forecast as a Key Economic Indicator

Updated June 24, 2024

Introduction

In the wake of prevailing economic uncertainties, it is crucial to look beyond the surface and delve into alternative indicators that could provide fresh insights. Enter Copper, often referred to as ‘Dr. Copper’ for its uncanny ability to predict economic trends. This piece offers a contrarian perspective, focusing on the predictive power of copper prices and what they potentially forecast for the broader financial landscape.

As we progress into 2024, supply and demand dynamics will undoubtedly shape copper’s pricing. With the ongoing global push towards green energy and electric vehicles, copper, a crucial component in these technologies, is set to witness surging demand. On the other hand, supply-side constraints due to mining issues and geopolitical tensions could potentially limit the availability of this essential commodity.

This juxtaposition of rising demand and constrained supply makes copper a compelling opportunity for investors and economists, providing an intriguing narrative to the global economic story.

Rangebound Action and Anticipating a Massive Price Anomaly

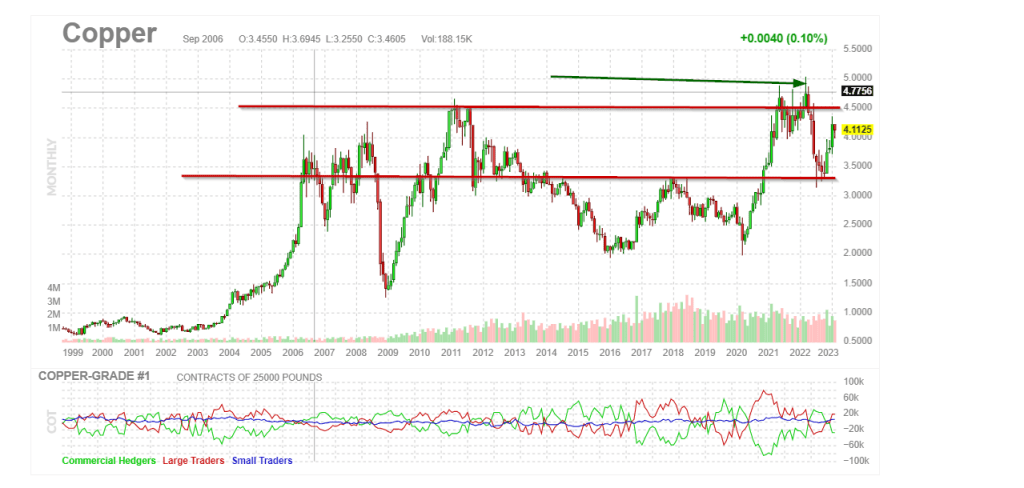

Copper trading has remained rangebound from 2006 to 2023, with occasional brief upticks. This pattern could foreshadow the broader market’s behaviour in the next 18 to 36 months, giving investors insight into potential market trends. As Copper typically leads the stock market, monitoring the copper price forecast is a critical indicator.

The rangebound action was interrupted by a sharp decline in 2008-2009, suggesting that a massive upward spike may be on the horizon. Consequently, Copper could trade within the 9-11 range in the coming years, potentially peaking at 15.00, presenting potential opportunities for savvy investors.

Copper Price Forecast for 2024

Copper is currently struggling to surpass the 3.90 mark. Unless the trend changes rapidly, it’s likely to drop to the 3.60 range before challenging the 4.20 to 4.44 range. Copper production is not anticipated to be sufficient to compensate for the shortfall, creating a favourable setup where both fundamentals and technical factors (as in TA) align in a bullish direction. More importantly, psychological factors also indicate a bullish long-term outlook. In essence, we have a well-rounded, long-term trifecta in play.

Interestingly, while it could be somewhat problematic, the lower the copper trades, the better. This is because it would turn a bullish picture into an outstandingly bullish one.

Copper demand is projected to rise due to its extensive use in electricity-related technologies and energy transition initiatives. In 2022, the trend continued, with global EV sales exceeding 10 million, a significant increase from the previous year. Brands like XPeng reported doubling their EV sales in June 2022, indicating a sustained rise in copper demand.

Global EV sales, including battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs), will reach 14.1 million units in 2023. This represents a 34% growth in EV sales compared to 2022, suggesting a further increase in copper demand. The continued growth in EV sales, coupled with the expansion of the EV-charging ecosystem, indicates a sustained and potentially increasing demand for copper in the foreseeable future.

On the supply side, a copper deficit is set to inundate global markets throughout 2023, fuelled by increasingly challenged South American supply streams and higher demand pressures.

The copper market is currently facing a supply-demand imbalance. Due to its usage in various technologies, demand is expected to increase, and supply is expected to fall short. This and psychological factors paint a bullish long-term picture for copper.

From this point onwards, we will take a slightly historical approach. The most important parts have been addressed above.

The Copper Price Forecast: The Man-Made Crisis and Economic Decline

Copper prices imply that the current crisis is man-made and that the U.S. is on a downward economic trajectory. The reckless sanctions imposed by the West have backfired, and their consequences will be felt in the coming years, impacting both the global economy and individual investments. Thus, keeping an eye on the copper price forecast is crucial for investors.

After a sharp pullback in March 2022, Copper found support in the 3.00-3.30 range. It has since challenged the 4.20 range and is building momentum to test the 4.50+ range. A monthly close at or above 4.50 could lead to a test of the 5.10 to 5.50 range, with a possible overshoot to 6.00, providing valuable insights for investors.

Copper Prices and Their Economic Message

Copper, as a leading economic indicator, conveys a clear message from a macroeconomic standpoint. Future market downturns and crashes should be viewed through a bullish lens, as the current crisis is man-made, and the U.S. is on a path of economic decline. A monthly close at or above 4.50 could lead to a test of the 5.10 to 5.50 range, with a possible overshoot to 6.00. Copper prices, which typically lead the stock market, are crucial to watch, informing investment decisions and providing a glimpse into the global economic climate.

As a leading economic indicator, Doctor Copper has traditionally been a reliable predictor of economic activity. However, with the advent of quantitative easing, this story has ended. Despite this, investors can still consider buying key copper stocks or going long via ETFs, provided they are willing to take on some risk. In 2022, copper prices reached record highs, revealing that issues with inflation and supply were merely symptoms of bad policies.

Doctor Copper, the moniker given to the metal due to its ability to predict economic trends, is currently in a coma. Copper has traditionally been a reliable predictor of economic activity, but this story has ended with the advent of quantitative easing. The Fed’s manipulation of the markets through ultra-low interest rates has created an artificial environment that favours speculators and punishes savers, leading to a disconnection of Dr Copper from the financial markets. Despite this, the masses still cling to Copper as an indicator, resulting in a missed opportunity for many investors.

Copper Price Forecast: Machine Learning Advancements and Global Dynamics

The copper market is experiencing a significant transformation driven by technological advancements and global economic shifts. Machine learning is playing a crucial role in revolutionizing copper price forecasting and production optimization:

Advanced forecasting models: Researchers have developed novel hybrid intelligence models for copper price forecasting, combining extreme learning machines with meta-heuristic algorithms. These models offer improved accuracy and reliability in both short-term and long-term predictions.

Production optimization: Machine learning techniques can boost metal recoveries by 2-4% and increase throughput by 5-15% in processing plants. This could add 0.5-1 million metric tons of refined copper to global production by 2032, generating $9-18 billion in value.

Behavioural economics impact: Applying machine learning in copper price forecasting introduces a new dimension to market psychology. As these models become more prevalent, they may influence trader behaviour and market sentiment, potentially leading to self-fulfilling prophecies in price movements.

Navigating Challenges in South American Supply Streams

South American copper supply faces multiple challenges in 2024, impacting the global market:

Freight recession: The logistics sector is experiencing soft pricing due to capacity outpacing demand, causing financial strain in the trucking sector.

Supply chain normalization: Due to persistent global issues, most logistics managers don’t expect supply chains to return to normal until 2024.

Labor shortages: The supply chain industry continues to grapple with workforce deficits, which hinder goods movement and increase costs.

Climate factors: Predictions of a moderate El Niño pattern could elevate power demand and prices in South American markets, further straining the supply chain.

Psychological impact: These challenges create uncertainty in the market, potentially leading to risk-averse behaviour among investors and consumers, which could further impact copper demand and prices.

Conclusion: Seizing the Copper Opportunity

The copper market is poised for significant growth and transformation:

Supply-demand imbalance: Global copper demand is projected to double by 2035, primarily driven by the energy transition sector and electric vehicles. This surge in demand and limited production creates a bullish long-term outlook for copper prices.

Technological advancements: The integration of machine learning and AI in copper production and price forecasting is reshaping the industry, offering new opportunities for efficiency and accuracy.

Investment opportunities: Copper ETFs and large-cap copper stocks present attractive options for investors looking to capitalize on the anticipated market growth.

Behavioural considerations: As awareness of copper’s critical role in the green energy transition grows, we may see increased speculative activity and potential market overreactions to supply-demand news.

Economic implications: The persistent copper shortage could have far-reaching effects on global economic health, inflationary pressures, and central bank policies.

In conclusion, the copper market is critical, with technological innovation, global economic shifts, and the clean energy transition driving unprecedented demand. Investors and industry players who recognize these trends and adapt accordingly stand to benefit significantly in the coming years.

Articles You’ll Love: Our Top Picks for Curious Minds

Considering the Impact of Inflation Why Investing is Important for Financial Security